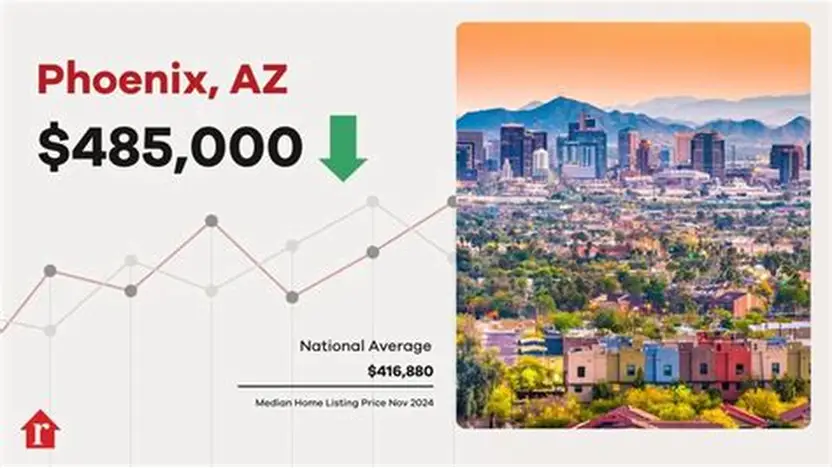

Phoenix Housing Market Correction: A Shift Toward Balance

The phrase “Phoenix housing market correction” has become more common in recent conversations among buyers, sellers, renters, and investors. After years of rapid price growth, competition, and limited supply, the market in and around Phoenix has shifted into a new phase. This shift has raised questions, concerns, and sometimes confusion about what a correction really means and what it does — and does not — signal about the local housing landscape.

A market correction is not the same thing as a collapse. It’s better described as a reset, where prices, demand, and expectations move closer to long-term trends. In Phoenix, this reset comes after one of the fastest housing booms in the country. That history matters, because the current changes make more sense when viewed in context rather than in isolation.

This piece takes a balanced, fact-based look at the Phoenix housing market correction. It avoids hype and fear-based narratives and instead focuses on data trends, economic drivers, and practical implications. The goal is to explain what’s happening in plain language — the same way you might break it down for a friend over coffee.

How Phoenix Got Here: From Rapid Growth to Market Reset

Phoenix didn’t stumble into a correction overnight. The current adjustment is the result of several years of extraordinary conditions that pushed prices and demand far above historical norms.

A period of unusually fast appreciation

For much of the late 2010s and early 2020s, Phoenix experienced strong population growth. People moved to the region for jobs, lower taxes, warm weather, and comparatively affordable housing. At the same time, new construction struggled to keep up with demand.

Then came a period of historically low interest rates. With borrowing costs reduced, buyers could afford more home for the same monthly payment. This combination of strong in-migration, limited supply, and cheap financing created intense competition.

In practical terms, this meant:

- Homes selling quickly, often within days

- Multiple offers becoming common

- Prices rising far faster than local incomes

- Buyers waiving contingencies to stay competitive

These conditions weren’t unique to Phoenix, but they were especially pronounced there. Over a short span, values climbed well above what long-term trends would typically suggest.

Why corrections often follow booms

Housing markets tend to move in cycles. When prices rise too quickly, affordability weakens. Eventually, demand cools, not because people no longer want homes, but because fewer people can afford them under prevailing conditions.

A simple comparison helps here. Imagine a concert ticket that normally costs $50. If demand pushes the price to $200, some fans will still buy — but many will wait, skip the show, or look for alternatives. If enough buyers step back, sellers adjust prices. Housing works in a similar way, just on a much larger and slower-moving scale.

The Phoenix housing market correction reflects this natural process. Prices didn’t collapse; they stopped racing upward and began adjusting toward levels that align more closely with incomes, financing costs, and buyer expectations.

Key Drivers Behind the Phoenix Housing Market Correction

Several forces are shaping the current market environment. None of them act alone, but together they explain why conditions feel different from just a few years ago.

Higher borrowing costs

One of the most influential changes has been the rise in mortgage interest rates. When rates increase, monthly payments go up — even if the home price stays the same.

For example:

- A buyer who could afford a $500,000 home at a low rate may only qualify for a $400,000 home at a higher rate.

- That doesn’t mean the buyer disappeared, but their price range shifted downward.

When many buyers experience this shift at the same time, demand softens at higher price points. Sellers who priced homes based on past peak conditions may need to adjust expectations.

More listings and longer selling times

During the height of the boom, homes in Phoenix often sold almost as soon as they were listed. In a correction phase, the pace slows.

Common signs include:

- Listings staying active longer

- More price reductions before a sale

- Fewer bidding wars

- Buyers taking time to negotiate terms

This doesn’t signal distress on its own. In fact, many consider it a return to a more balanced market, where both sides have time to make thoughtful decisions.

Shifting investor activity

Phoenix has long attracted real estate investors, including those focused on long-term rentals. As financing costs rise and price growth slows, some investors become more selective or step back temporarily.

This shift can reduce competition in certain segments, especially entry-level and mid-priced homes. It also changes the dynamics between owner-occupants and investment buyers.

Organizations such as Ashcroft Capital, which focus on multifamily assets, operate in a different segment than single-family buyers. Still, broader investor sentiment influences confidence and pricing across the housing ecosystem.

Sellers adjusting to new realities

Many homeowners still remember peak prices and fast sales. When the market changes, there’s often a gap between what sellers expect and what buyers are willing to pay.

This gap can lead to:

- Homes being listed, withdrawn, and relisted

- Gradual price adjustments over weeks or months

- Increased use of concessions rather than headline price cuts

Over time, as transactions close at new price levels, expectations tend to realign.

What the Correction Looks Like on the Ground

The Phoenix housing market correction isn’t uniform. It shows up differently depending on neighborhood, price range, and property type.

Entry-level and mid-range homes

These segments are often the most sensitive to affordability changes. Buyers in this range typically rely more on financing and are more affected by interest rate shifts.

As a result, this part of the market may experience:

- More noticeable price adjustments

- Increased negotiation around closing costs

- Greater inventory compared to recent years

At the same time, demand hasn’t vanished. Many households still want to buy but are waiting for the right combination of price and payment.

Higher-end and luxury properties

Luxury markets tend to move on different timelines. Buyers may rely less on financing, and decisions are often influenced by lifestyle factors rather than purely monthly costs.

In Phoenix, higher-end properties may:

- Take longer to sell

- See fewer price cuts but more incentives

- Remain resilient in highly desirable areas

This uneven adjustment is one reason broad headlines can be misleading. A “correction” doesn’t affect every home in the same way.

Rentals and housing supply

The correction also intersects with the rental market. As buying becomes more expensive, some households choose to rent longer. That can support rental demand even as home prices adjust.

At the same time, new housing supply — especially multifamily — adds options for renters and can moderate rent growth over time. This balance between ownership and renting is part of the broader housing picture in Phoenix.

What It Means for Buyers, Sellers, and Long-Term Outlook

Understanding the Phoenix housing market correction is less about predicting short-term price moves and more about recognizing how conditions are changing.

For buyers

Buyers may find:

- More choices than in recent years

- Greater ability to negotiate price or terms

- Less pressure to make rushed decisions

However, affordability remains a challenge. A lower price doesn’t always translate to a lower payment if borrowing costs stay elevated. Buyers benefit from running realistic numbers and planning for long-term ownership rather than short-term gains.

For sellers

Sellers face a more competitive environment. Success often depends on:

- Pricing homes based on current conditions, not past peaks

- Preparing properties well for showings

- Being open to negotiations or concessions

Homes that are priced appropriately and well-maintained still sell, even in a correction.

For investors and planners

From a long-term perspective, corrections can create healthier markets. They slow unsustainable growth and reduce the risk of larger imbalances.

Investors focused on fundamentals — such as employment, population trends, and housing needs — may view the Phoenix correction as part of a normal cycle rather than a warning sign.

This broader view is something Newsta often emphasizes: markets evolve, and context matters more than headlines.

Conclusion: A Reset, Not a Breakdown

The Phoenix housing market correction reflects a shift from an unusually fast, competitive period to a more measured environment. Prices have adjusted, activity has slowed, and expectations are being recalibrated. None of this automatically signals long-term weakness.

Phoenix continues to attract residents, businesses, and investment. Housing demand hasn’t disappeared — it has changed shape. Buyers are more cautious, sellers are more realistic, and the market is finding its footing after years of imbalance.

For anyone watching the Phoenix housing market correction, the key takeaway is balance. This phase rewards patience, planning, and perspective. Markets move in cycles, and this one appears to be about restoring equilibrium rather than rewriting the region’s housing story.

Frequently Asked Questions About the Phoenix Housing Market Correction

What does a housing market correction mean in Phoenix?

A housing market correction in Phoenix refers to a period where home prices slow down or decline slightly after rising very quickly. It’s a market adjustment, not a crash, and often follows years of strong demand and rapid appreciation.

Is the Phoenix housing market crashing?

No. A correction is different from a crash. A crash usually involves widespread foreclosures, sharp price drops, and financial stress. The Phoenix housing market correction reflects cooling demand, longer selling times, and more realistic pricing — not systemic failure.

Why are Phoenix home prices going down?

Prices are adjusting mainly due to higher mortgage rates, reduced affordability, and increased housing inventory. When buyers have less purchasing power, sellers often need to lower prices or offer incentives to close deals.

How long will the Phoenix housing market correction last?

There’s no fixed timeline. Corrections can last months or a few years, depending on interest rates, job growth, population trends, and housing supply. Many analysts view the current phase as a gradual reset rather than a sharp downturn.

Is now a bad time to buy a home in Phoenix?

It depends on personal circumstances. Buyers may benefit from more options and less competition than in past years. However, higher interest rates mean monthly payments may still be challenging. Long-term plans matter more than short-term market timing.

Should sellers wait until the market improves?

Some sellers choose to wait, while others move forward based on life needs such as relocation or downsizing. Homes that are priced realistically and presented well can still sell during a correction, though patience may be required.

Are all Phoenix neighborhoods affected the same way?

No. The Phoenix housing market correction is uneven. Entry-level and mid-priced homes tend to feel more pressure, while desirable or supply-constrained areas may remain more stable. Local factors play a big role.

What does this mean for Phoenix renters?

Renters may see more choices as new housing supply enters the market. While rent growth has slowed in some areas, demand remains strong due to affordability challenges in homeownership.

Can home prices rise again after a correction?

Yes. Housing markets are cyclical. If population growth, employment, and affordability improve, prices can stabilize and eventually rise again. Corrections often help create healthier long-term conditions.

How should investors view the Phoenix housing market correction?

Many investors focus on long-term fundamentals rather than short-term price changes. A correction can reduce risk, improve entry points, and encourage more disciplined pricing across the market.