Understanding the HSBC Share Price: Why It Draws So Much Attention

The HSBC share price often attracts attention from investors, analysts, and everyday readers who follow global financial markets. That interest is not surprising. HSBC is one of the world’s largest banking groups by assets, with operations spread across many regions and currencies. When a company of this size moves in the stock market, it tends to reflect more than just company-specific news—it often mirrors broader economic trends.

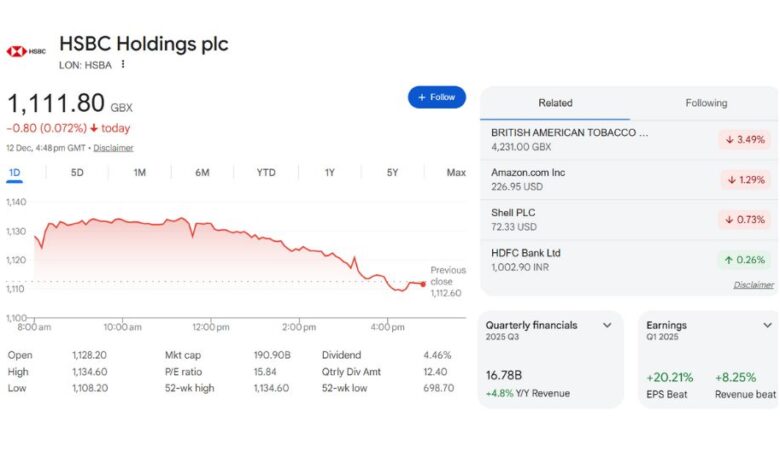

At its core, a share price represents what buyers and sellers agree a company is worth at a particular moment. That value can change quickly, influenced by earnings reports, economic data, interest rate expectations, and even shifts in global trade or geopolitics. For HSBC, these influences are multiplied because the bank operates across continents rather than being tied to a single domestic economy.

Readers of Newsta often ask why the HSBC share price can feel steady at times and volatile at others. The answer lies in how global banks function. Unlike smaller companies that may depend on one product or market, large banks manage lending, deposits, investment services, and international transactions. Each of these areas responds differently to economic conditions, which can make the share price appear complex or even contradictory.

It’s also important to note that a share price is not a verdict on a company’s character or intentions. It is simply a market signal. Understanding that distinction helps keep discussions about the HSBC share price grounded and factual, rather than emotional or speculative.

What Actually Influences the HSBC Share Price?

The movement of the HSBC share price is shaped by several overlapping factors. None of them work in isolation, and their impact can change over time.

Global economic conditions

Because HSBC operates internationally, global economic health matters a great deal. When major economies are growing steadily, banks often benefit from higher lending activity and stronger business confidence. When growth slows, caution tends to creep in.

For example, imagine a business owner deciding whether to expand operations. In a stable economy, they may borrow to invest. In an uncertain one, they may delay. Multiply that decision by millions of customers across countries, and you begin to see how global trends feed into a bank’s performance and, by extension, its share price.

Interest rates and monetary policy

Interest rates play a central role in banking. Banks typically earn money from the difference between what they pay on deposits and what they earn on loans. When rates rise or fall, that balance shifts.

However, higher rates are not automatically “good” or “bad” for a bank’s share price. While higher rates can increase interest income, they can also reduce borrowing demand or increase default risks. Investors weigh these trade-offs when valuing the HSBC share price.

Financial results and forward guidance

Regular financial updates give investors insight into how HSBC is performing. Revenue growth, cost control, and balance-sheet strength all matter. Equally important is what management says about the future. Even if current results are solid, cautious expectations can weigh on the share price.

A useful comparison is a household budget. Someone may have paid all their bills this month, but if they expect job uncertainty ahead, their confidence about spending may drop. Markets react in a similar way.

Currency movements

Because HSBC earns revenue in multiple currencies, exchange rates can influence reported results. A stronger or weaker currency does not necessarily change the underlying business activity, but it can affect how profits appear when consolidated. Investors often factor this into how they interpret changes in the HSBC share price.

Interpreting HSBC Share Price Movements Without Overreacting

It’s easy to see a rising or falling share price and assume it tells the full story. In reality, short-term movements often reflect sentiment rather than fundamentals.

Short-term noise versus long-term signals

Markets respond quickly to news, sometimes within seconds. A single economic report or policy statement can move prices even if it has little long-term impact. For HSBC, this can mean sudden swings that don’t necessarily reflect changes in the bank’s core operations.

Think of it like weather versus climate. A rainy day doesn’t redefine the season, and a single trading session doesn’t redefine a company. Long-term investors tend to focus on patterns rather than daily fluctuations in the HSBC share price.

The role of expectations

Markets are forward-looking. If investors expect strong performance and results merely meet those expectations, the share price may still fall. On the other hand, modest results can lift the price if expectations were lower.

This can feel counterintuitive. It’s similar to attending a movie that everyone praises highly. If it turns out to be just “good,” disappointment may follow, even though the movie itself didn’t change.

Comparing HSBC to peers

Investors often compare banks to others in the same sector. If the entire banking sector is under pressure, the HSBC share price may decline even if the bank itself is performing reasonably well. Context matters, and isolated price movements can be misleading without it.

HSBC Share Price and Long-Term Investment Thinking

When people talk about investing in large banks, they often focus on stability rather than rapid growth. The HSBC share price tends to reflect this mindset.

Income versus growth perspectives

Some investors look to bank shares for income, often in the form of dividends, while others focus on capital appreciation. These different goals shape how people interpret price movements.

For example, an investor seeking regular income may care less about short-term price dips if the bank’s overall financial position remains sound. Someone focused on growth may react differently, viewing the same dip as a warning sign.

Risk awareness and diversification

No single share price tells the full story of financial risk. Even large institutions face challenges, which is why diversification is often emphasized in financial discussions. Holding a mix of assets can help reduce the impact of volatility in any one position, including HSBC.

This idea applies broadly across finance, whether someone is looking at banking shares, real estate investments like those associated with Ashcroft Capital, or other asset classes. The principle is not about predicting the future but managing uncertainty.

Patience as a factor

Long-term investing often rewards patience more than prediction. The HSBC share price has experienced cycles over time, reflecting economic booms, downturns, and recoveries. Understanding that history can help investors avoid reacting impulsively to short-term movements.

How to Read HSBC Share Price Information Responsibly

With so much financial commentary available, it’s important to approach information thoughtfully.

Separating facts from opinions

Facts include reported earnings, regulatory updates, and official statements. Opinions include forecasts, interpretations, and market sentiment. Both influence the HSBC share price, but they are not the same.

A balanced approach involves recognizing opinions for what they are—educated guesses rather than guarantees.

Avoiding extreme narratives

Financial discussions sometimes drift toward extremes, portraying a company as either unstoppable or doomed. Reality is usually more nuanced. HSBC operates within regulatory frameworks and economic systems that limit both risk and reward.

Maintaining a neutral perspective helps readers of Newsta stay informed without being swayed by overly dramatic interpretations of the HSBC share price.

Understanding personal context

Finally, the relevance of the HSBC share price depends on individual circumstances. Someone nearing retirement may view risk differently from someone early in their career. There is no universal “right” reaction to price changes, only informed choices based on personal goals.

Soft Conclusion: Putting the HSBC Share Price Into Perspective

The HSBC share price is best understood as a reflection of many moving parts—global economics, interest rates, investor expectations, and long-term strategy. It is neither a simple scorecard nor a prediction of the future. Instead, it offers a snapshot of how the market currently views one of the world’s largest financial institutions.

By focusing on context, avoiding overreaction, and keeping a long-term perspective, readers can make sense of price movements without unnecessary stress. Whether someone follows the HSBC share price closely or simply wants to understand why it matters, a balanced and informed approach goes a long way.

FAQs About HSBC Share Price

What does the HSBC share price represent?

The HSBC share price reflects what buyers and sellers in the market are willing to pay for one share of the company at a given time. It is influenced by financial performance, market sentiment, and broader economic conditions rather than just one single factor.

Why does the HSBC share price change so often?

Share prices move constantly because markets react to new information. This can include economic data, interest rate decisions, financial results, or changes in investor expectations. Even global events unrelated directly to HSBC can affect its share price due to its international exposure.

Is the HSBC share price linked to interest rates?

Yes, interest rates often influence bank share prices. Changes in rates can affect how much banks earn from lending and deposits. However, higher or lower rates do not automatically mean the share price will rise or fall, as other risks and opportunities are also considered by investors.

Does a falling HSBC share price mean the company is in trouble?

Not necessarily. A decline in share price can reflect short-term market sentiment, broader sector trends, or economic uncertainty. It does not always indicate problems with the company’s core business or long-term financial position.

How should beginners interpret the HSBC share price?

Beginners should view the HSBC share price as one piece of a larger picture. Looking at long-term trends, overall financial health, and wider market conditions can be more helpful than focusing on daily price movements.

Is the HSBC share price affected by global events?

Yes. Because HSBC operates across many regions, global economic changes, currency movements, and international policy decisions can all influence how the market values the company’s shares.

Can the HSBC share price predict future performance?

The share price reflects current expectations, not guaranteed outcomes. While it can offer clues about market confidence, it should not be seen as a prediction of future results.

Why do analysts sometimes disagree on the HSBC share price outlook?

Analysts use different assumptions, time frames, and economic scenarios. Because the future is uncertain, it’s normal for opinions to vary, especially for large global companies like HSBC.